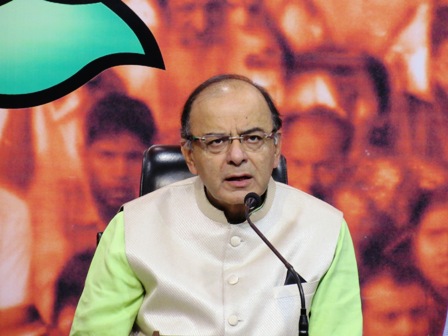

Arun Jaitley urges J&K to roll out GST from July 1

Asking Jammu and Kashmir government to implement GST from July 1st, Union Finance Minister, Arun Jaitley has said that failure to implement GST in J&K will lead to ‘adverse effects’.

“Failure to implement GST will lead to price rise and put the local industry at a disadvantage,” Jaitley said.

Jammu & Kashmir will have to pass special laws to be able to implement the Goods and Services Tax as its current Constitutional status does not mandate the applicability of the new indirect tax reform in the state.

Jaitley said since Integrated GST (IGST) will be levied on all inter-state supplies of goods and services, credit for goods purchased in one state can be claimed in the state where it is sold.

“If the state of J&K does not join GST on July 1, 2017, for all purchases made by the state from other states after July 1, the dealer shall not be able to take credit of this IGST which shall get embedded into the price of purchased good or service, leading to cascading of tax and increase in price of the said good or service for the final consumers in J&K,” Jaitley wrote in the letter.

Jammu and Kashmir, he said, had actively participated in the GST Council meetings and had meaningfully contributed to the framing of the various laws and rules for GST. The 14th meeting of the GST Council was held in Srinagar on May 18-19 in which rates of over 1,200 goods and 500 services were decided. In his letter, Jaitley urged the Chief Minister to send the concurrence of the state on the GST Constitutional Amendment Act, 2016, for the approval of the President.

As per Article 370 of the Constitution, amendments made in Constitution of India are applicable to Jammu and Kashmir with the concurrence of the state government and approval of the President.