Maximise Your Monthly Income Scheme Returns with the Help of the NPS Calculator

In terms of financial planning, most individuals seek alternatives that can give them a secure and certain source of income during retirement. One of the most sought-after means of doing this is the monthly income scheme, a plan made to provide retired elderly persons with a guaranteed fixed monthly payment to sustain their expenses and lifestyles.

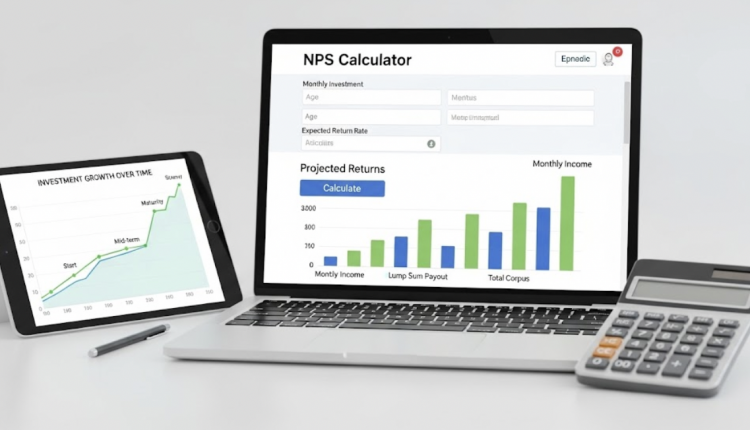

But investing in a monthly income scheme is not enough. To maximise your returns, you can use a National Pension Scheme (NPS) calculator. With this tool, you can approximate your retirement corpus and match your investments to your post-retirement income requirements.

Understanding the Monthly Income Scheme

A monthly income scheme is an investment plan that offers you a fixed monthly return after a definite tenure or at retirement. It is very similar to drawing a salary; you receive periodic payments, which enable you to cover your expenses on a day-to-day basis without touching your savings.

This kind of scheme has various options:

- Government-backed schemes like the Post Office Monthly Income Scheme (POMIS)

- Insurance-linked annuities offered by life insurers

- Retirement schemes like the National Pension Scheme (NPS), where part of your corpus is used to buy annuities after retirement

The key benefit of these schemes is financial stability. Rather than being worried about fluctuations in the market or having to liquidate assets, you can have a fixed income which is budgeted beforehand.

Why Planning Your Monthly Income Matters?

Without proper planning, you might end up with either:

- A monthly income that’s not enough to support your living needs, or

- Depleting your retirement savings too quickly

Here’s why you must plan wisely:

- Inflation effect: With time, the cost of living increases. Your monthly payments need to be high enough to keep your purchasing power.

- Longevity risk: With life expectancy increasing, your retirement funds may need to last for 25–30 years.

- Lifestyle choices: Whether you want to travel, pursue hobbies, or support your family, your monthly income should match your lifestyle needs.

This is where the National Pension Scheme calculator becomes essential. It takes these factors into account and gives you a realistic projection of your future income.

The Role of the National Pension Scheme Calculator

The National Pension Scheme calculator is an online calculator to aid you in estimating your pension wealth and your post-retirement monthly income based on your investment term, your contribution, and your anticipated rate of return. This is what it generally does:

- Estimates total corpus: Based on your current age, retirement age, and monthly contribution, it calculates how much you’ll have at retirement.

- Project monthly pension: It shows how much you can expect to receive each month after buying an annuity from your corpus.

- Compares scenarios: You can adjust variables like contribution amount, retirement age, and expected returns to see how they affect your income.

By experimenting with different inputs, you can identify the ideal contribution strategy to maximise your monthly income scheme returns.

How to Use the NPS Calculator Effectively?

It is easy to use the National Pension Scheme calculator, and to make the most of it, follow these steps:

- Input Your Data

Enter these details into the NPS calculator. Many calculators also ask for the percentage of your corpus that you would like to invest to purchase an annuity.

- Review the Output

The calculator will show:

- The estimated total corpus at retirement

- Projected monthly pension according to annuity rates

- A lump sum amount you can withdraw at retirement

- Adjust for Your Goals

Play around with different scenarios:

- Increase contributions gradually

- Extend your retirement age

- Adjust the annuity percentage

This enables you to refine your plan so that your monthly income scheme corresponds to your future requirements.

Tips to Maximise Your Monthly Income Scheme Returns

Below are some tips to assist you in securing the maximum possible returns from your NPS and corresponding monthly income schemes:

- Start Early

The sooner you start investing, the more compounding time your money has. Small monthly investments made when you are young can lead to a much bigger corpus at retirement.

- Change Contributions Over Time

With your growing income, increase your NPS contribution. Small changes here will make big differences to your final corpus.

- Choose the Right Asset Allocation

The NPS provides a choice of equity, corporate debt, or government securities. Equities will give you higher returns over the long term but involve higher risk. Adjust the allocation according to your age and risk tolerance.

- Monitor and Adjust

Keep reviewing your NPS portfolio regularly and match it with your investment goals.

- Optimise Annuity Purchase

When you retire, a part of your NPS corpus will be used to purchase an annuity. Compare annuity providers and choose one that offers competitive rates and reliable payouts.

Common Mistakes to Avoid

Even with the best tools, certain errors can reduce your retirement income:

- Underestimating inflation: Always budget with higher costs for the future.

- Failing to update contributions: Continue to adjust for pay growth and inflation.

- Overlooking annuity choices: Various annuity schemes have different benefits; compare before selecting.

Conclusion

A monthly income scheme can provide you with financial stability and peace of mind during retirement. Using the National Pension Scheme calculator, you can project your future corpus and make contributions as per your financial requirements. By starting early, increasing contributions over the years, and opting for the proper plan, you can earn better monthly returns and ensure your standard of living against inflation. Retirement planning is not just saving; it’s having the income to live comfortably when you’re not working.

Comments are closed.