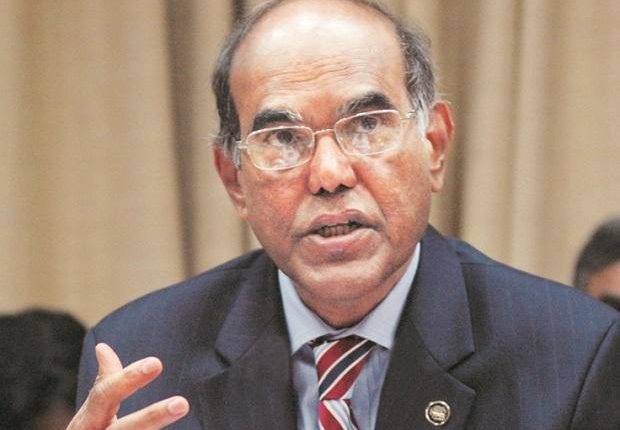

Talking about the monetary policy response of the RBI to the pandemic, Dr Duvvuri Subbarao, Former Governor, Reserve Bank of India, stated that all actions of the RBI were driven by the dual objective of achieving financial stability and preventing a financial crisis, and secondly, transmitting money to productive sectors of the economy. He was speaking at the session titled ‘COVID Impact: Case for Coordinated Monetary Policy Response’ organized by CII at the Partnership Summit 2020 with Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry. He noted that while managing a crisis is extremely difficult, RBI had been successful in preserving the financial stability of the economy during the present crisis.

He reflected that there were certain key elements to the central bank’s monetary policy response so far. The first was the extraordinary injection of liquidity through Open Market Operations (OMO), cut in CRR and SLR. The second was the easing of the financial conditions through the lowering of policy rates, reverse repo rates, Targeted Long-Term Repo Operations (TLTRO) for specific sectors. The third was the regulative forbearance through the introduction and extension of the loan moratorium. However, he indicated that given the excessive liquidity in the system it could become a challenge to wind down liquidity going forward.

Further, commenting on the government spending, he stated that though expansionary fiscal policy is the need of the hour and government spending on health and education would only be beneficial for the economy, the fiscal deficit this year could be double of the budgeted fiscal deficit. He noted that while managing debt would be another challenge for the government, he reassured that a roadmap for fiscal consolidation starting in 2022 would be a prudent move. Commenting on the inter-relationship between the monetary and fiscal policy, Dr Subbarao asserted that two go hand-in-hand and monetary policy of a nation has to always conform with the fiscal policy, not only for India but all countries of the world.

Dr Subbarao reflected that though the government and central banks of the world are presently operating from the playbook of the Global Financial Crisis in 2008-09, the coronavirus crisis is quite different. He elaborated that while GFC was an asset crisis that hit the financial sector first, the coronavirus crisis first impacted the real sector. Further, he pointed out that since the root of the present crisis lay in science, there is only so much that the government and the central bank can do until science finds a solution.

Dr Shankar Acharya noted that while the impact of the lockdown has been severe, the Indian economy can be expected to recover to positive territory by the third or fourth quarter of this financial year.