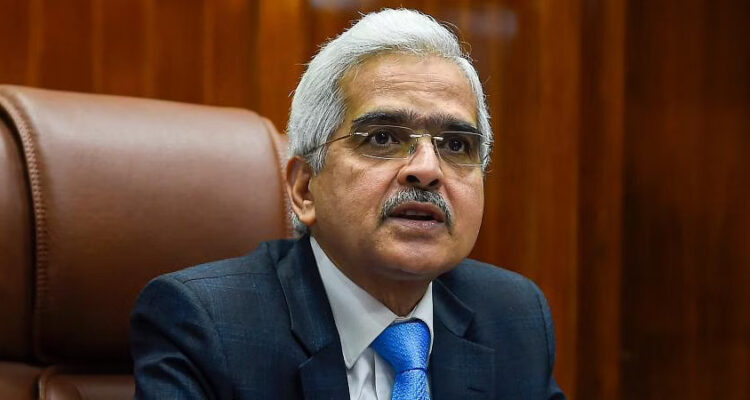

RBI governor Shaktikanta Das Makes Post MPC Statement, Repo Rate to Remain Unchanged at 6.5%

Ten News Network

New Delhi(India), 10/08/23: In a post-monetary policy news conference on Thursday, RBI governor Shaktikanta Das stated that incremental CRR for scheduled commercial banks is likely to reduce liquidity by little more than Rs 1 lakh crore. Das went on to say that the incremental CRR for banks is just temporary and would be reassessed on September 8.

Earlier in the day, he unveiled a slew of initiatives to enhance UPI payments. These included increasing the UPI lite transaction limit from Rs 200 to Rs 500. Das also stated that offline payments via UPI will be available shortly, as well as conversational payments on the platform.

Das has previously stated that the repo rate will remain constant at 6.50 percent. He also stated that the central bank’s stance on accommodation has not altered. Das forecasts real GDP growth of 6.5 percent for 2023-24, with Q1 at 8%, Q2 at 6.5 percent, Q3 at 6%, and Q4 at 5.7 percent.

According to Das, the central bank expects CPI inflation to be 5.4% in 2023-24 assuming the monsoon remains regular. He went on to say that CPI inflation for the second quarter of 2023-24 is expected to be 6.2%, 5.7% in the third quarter, and 5.2% in the fourth quarter.

CPI inflation is expected to be 5.2% in the first quarter of 2024-25. He went on to say that India’s solid macroeconomic fundamentals have resulted in rapid growth.

In terms of inflation patterns, he stated that a rise in tomato costs, as well as cereal and pulse prices, led to inflation. He also mentioned that vegetable costs could fall significantly.

Das also stated that India contributes roughly 15% of global growth, while banks remain the healthiest in over a decade. The RBI policy meeting was held this month from August 8 to 10.