New Delhi (India), 6th April 2023: Based on the macroeconomic environment and its projections, the Reserve Bank of India’s Monetary Policy Committee (MPC) unanimously agreed on Thursday to maintain the policy repo rate at 6.5% while remaining prepared to take action should the need arise.

Therefore, the marginal standing facility (MSF) rate and the bank rate will both continue at 6.75%, while the standing deposit facility (SDF) rate will stay at 6.25%.

The MPC also resolved with a majority of 5 out of 6 members to continue concentrating on the removal of accommodation to ensure that inflation gradually aligns with the goal while promoting growth.

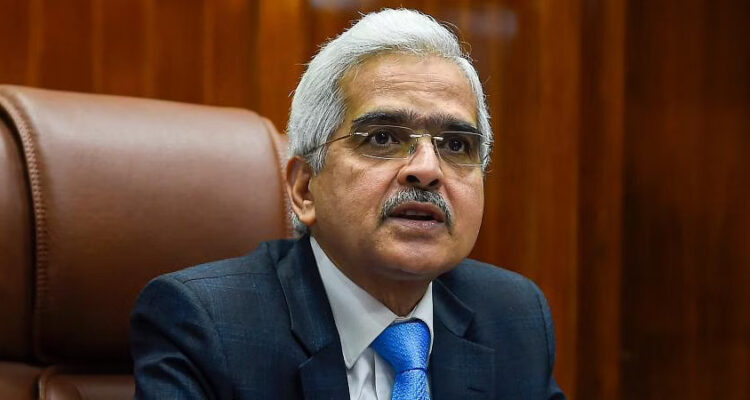

Governor Shaktikanta Das provided an explanation of the MPC’s reasoning for these choices regarding the policy rate and stance in his monetary policy statement. He said, “While the recent high frequency indicators suggest some improvement in global economic activity, the outlook is now tempered by additional downside risks from financial stability concerns.”

He further added, “Headline inflation is moderating but remains well above the targets of central banks. These developments have led to heightened volatility in global financial markets as reflected in sizeable two-way movements in bond yields.”

In his comments on inflation, Mr. Das stated that both import inflation pressures and the growing level of uncertainty in global financial markets need to be carefully watched.

Taking into account various factors and assuming an annual average crude oil price (Indian basket) of $85 per barrel and a normal monsoon, CPI inflation is projected to moderate to 5.2% for 2023-24; with Q1 at 5.1%; Q2 at 5.4%; Q3 at 5.4%; and Q4 at 5.2%. The risks are evenly balanced.